Fortran Finance

Monte Carlo Simulation

| Author: | Mitch Richling |

| Updated: | 2025-11-06 09:21:32 |

| Generated: | 2025-11-06 09:21:33 |

Copyright © 2025 Mitch Richling. All rights reserved.

Table of Contents

These examples both use simple, resampling monte carlo on historical US financial data. Both examples include both Fortran code to run the simulations, and R code to visualize them. One of the examples illustrates endpoint distribution forecasting while the other illustrates trajectory forecasting.

1. inflation.f90 & inflation.R

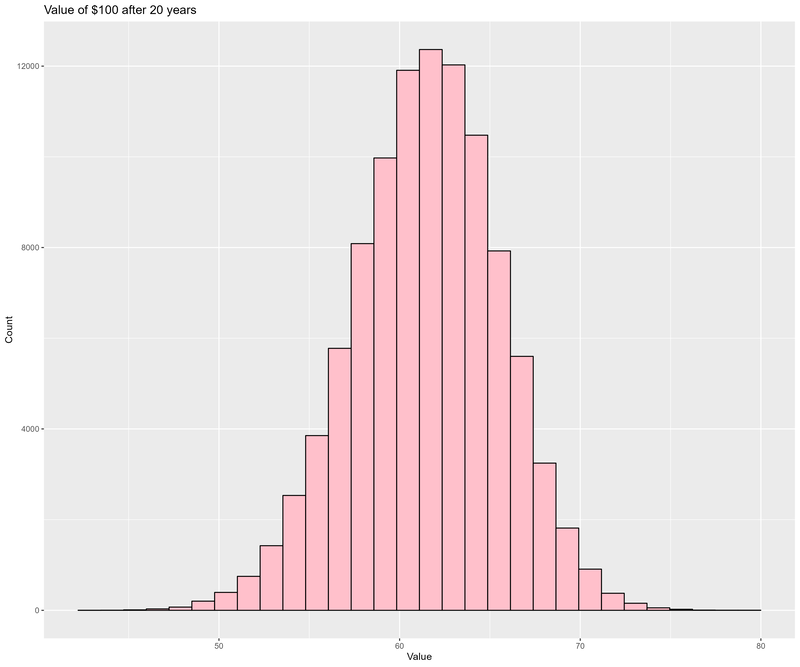

This program runs 100000 (tirals) Monte Carlo simulations of inflation for $100 (initial_value) over 20 (years) years

using the last 30 (mc_history_years) years of historical US inflation data. This program prints the value after 20 years

for each simulation to STDOUT. If placed in a file, this data may be consumed by inflation.R to produce a nice histogram

showing the probability of the value after 100 years.

Here is the Fortran code (inflation.f90):

program inflation use :: mrffl_config, only: rk use :: mrffl_us_inflation, only: inf_resample implicit none (type, external) integer, parameter :: years = 20 ! Number of years to project out our inflation adjusted value integer, parameter :: mc_history_years = 30 ! Number of years of US inflation data for our random inflation values integer, parameter :: trials = 100000 ! Number of trials to run real(kind=rk), parameter :: initial_value = 100 ! This is the value we will inflation adjusted over the years real(kind=rk) :: value real(kind=rk) :: i integer :: year, trial ! Run monte carlo simulations and dump the results to STDOUT print *, "trial value" do trial=1,trials value = initial_value do year=2,years i = inf_resample(mc_history_years) value = value * (1 - i/100) end do print *, trial, value end do end program inflation

And here is the R code (inflation.R):

source('../setup.R') daDat <- fread("inflation.txt") gp <- ggplot(data=daDat) + geom_histogram(aes(x=value), bins=30, col='black', fill='pink') + labs(title='Value of $100 after 20 years', x='Value', y='Count') fname <- "inflation.png" ggsave(fname, width=12, height=10) if (is.character(imageV)) system(paste(imageV, fname, sep=' '))

2. stocks.f90 & stocks.R

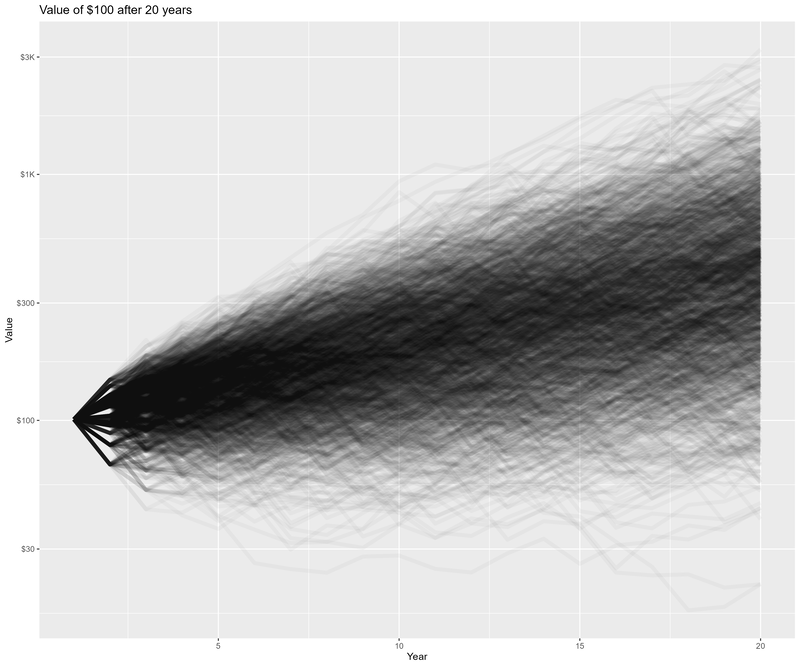

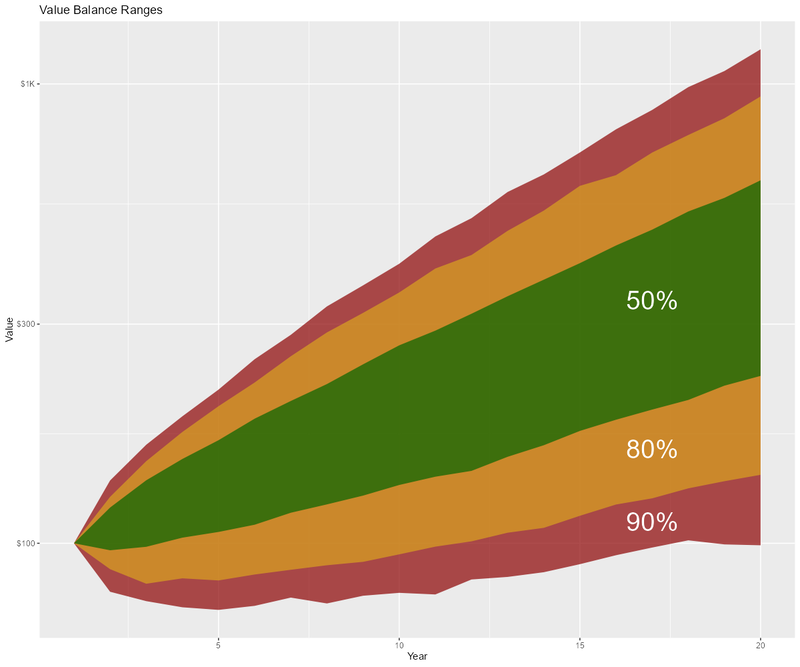

This program runs 2000 (trials) stocks simulations on $100 (initial_value). Each simulation is over 20 (years) years

using the last 30 (mc_history_years) years of historical US stocks data. This program prints the resulting value of each

simulation to STDOUT. If placed in a file, this data may be consumed by stocks.R to produce a nice histogram showing the

probability of the value after 100 years.

Here is the Fortran code (stocks.f90):

program stocks use :: mrffl_config, only: rk use :: mrffl_us_markets, only: rut_resample use :: mrffl_percentages, only: add_percentage implicit none (type, external) integer, parameter :: years = 20 ! Number of years to project out our stocks adjusted value integer, parameter :: mc_history_years = 30 ! Number of years of US stocks data for our random stocks values integer, parameter :: trials = 2000 ! Number of trials to run real(kind=rk), parameter :: initial_value = 100 ! This is the value we will stocks adjusted over the years real(kind=rk) :: value real(kind=rk) :: i integer :: year, trial ! Run monte carlo simulations and dump the results to STDOUT print *, "trial year value" do trial=1,trials value = initial_value print *, trial, 1, value do year=2,years i = rut_resample(mc_history_years) value = add_percentage(value, i) print *, trial, year, value end do end do end program stocks

And here is the R code (stocks.R):

source('../setup.R') daDat <- fread("stocks.txt") %>% mutate(trial=factor(trial)) gp <- ggplot(data=daDat) + geom_line(aes(x=year, y=value+1, group=trial), alpha=0.03, linewidth=2, col='black', show.legend=FALSE) + scale_y_continuous(labels = scales::label_dollar(scale_cut = cut_short_scale()), trans='log10') + labs(title='Value of $100 after 20 years', x='Year', y='Value') fname <- "stocks_paths.png" ggsave(fname, width=12, height=10) if (is.character(imageV)) system(paste(imageV, fname, sep=' ')) bands <- c(90, 80, 50) sumDat <- group_by(daDat, year) %>% summarize(band_90_0 = pmax(0, quantile(value, (50-bands[1]/2)/100)), band_90_1 = pmax(0, quantile(value, (50+bands[1]/2)/100)), band_80_0 = pmax(0, quantile(value, (50-bands[2]/2)/100)), band_80_1 = pmax(0, quantile(value, (50+bands[2]/2)/100)), band_50_0 = pmax(0, quantile(value, (50-bands[3]/2)/100)), band_50_1 = pmax(0, quantile(value, (50+bands[3]/2)/100)), .groups='keep') gp <- ggplot(sumDat) + geom_ribbon(aes(x=year, ymin=band_90_0, ymax=band_90_1), fill='darkred', alpha=0.7) + geom_ribbon(aes(x=year, ymin=band_80_0, ymax=band_80_1), fill='goldenrod', alpha=0.7) + geom_ribbon(aes(x=year, ymin=band_50_0, ymax=band_50_1), fill='darkgreen', alpha=0.7) + annotate("text", x=17, y=mean(c(sumDat$band_90_0[17], sumDat$band_80_0[17])), label="90%", col='white', size=10, vjust=0.5) + annotate("text", x=17, y=mean(c(sumDat$band_80_0[17], sumDat$band_50_0[17])), label="80%", col='white', size=10, vjust=0.5) + annotate("text", x=17, y=mean(c(sumDat$band_50_0[17], sumDat$band_50_1[17])), label="50%", col='white', size=10, vjust=0.5) + scale_y_continuous(labels = scales::label_dollar(scale_cut = cut_short_scale()), trans='log10') + labs(title='Value Balance Ranges') + ylab('Value') + xlab('Year') fname <- 'stocks_ranges.png' ggsave(fname, width=12, height=10, dpi=100, units='in', plot=gp); if (is.character(imageV)) system(paste(imageV, fname, sep=' '))

3. blend_risk.f90 & blend_risk.R

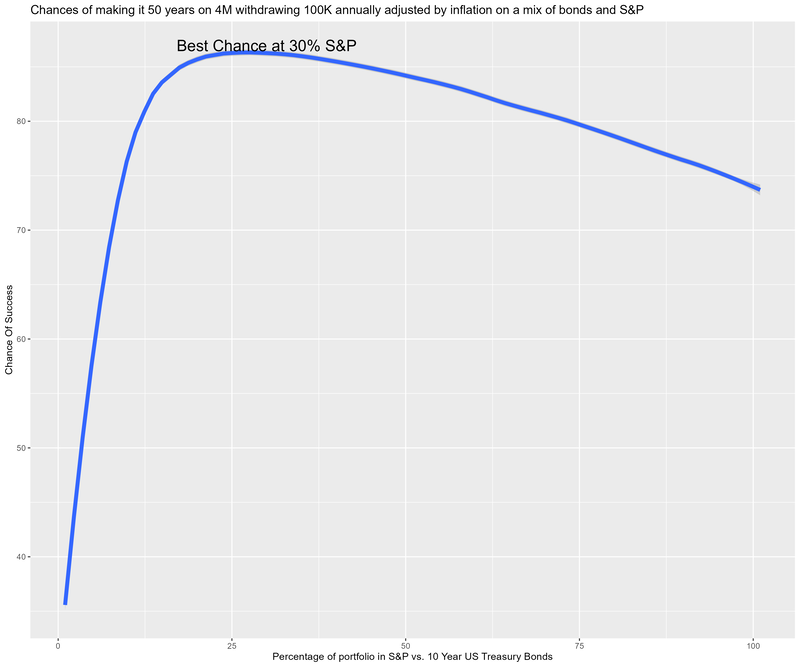

Scenario:

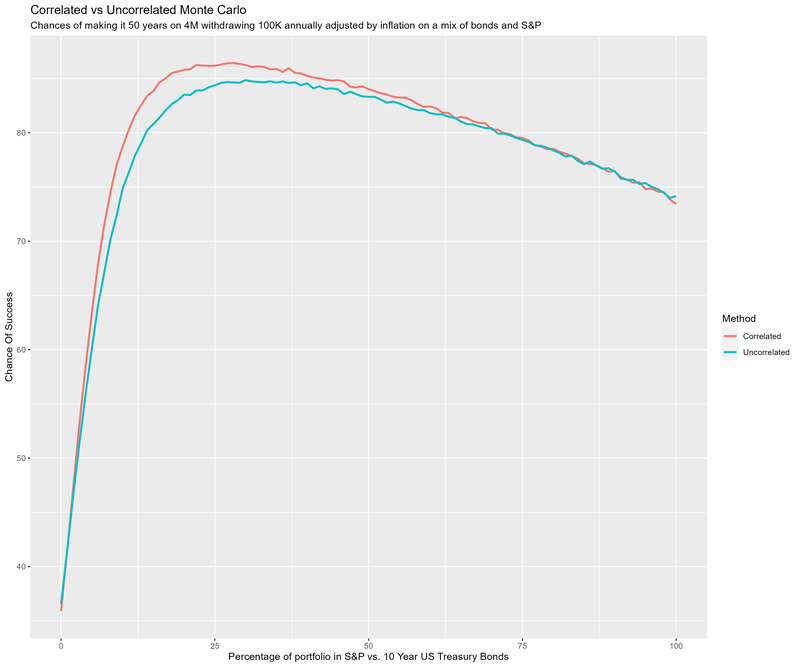

We start with 4M in the bank. Over the next 50 years we wish to withdrawal 100K at the end of each year – and grow that value over time with inflation. We invest the money in a blend of S&P 500 and US 10 year treasury bonds.

Approach:

For each possible integer percentage mix of S&P & bonds (i.e. percentages of S&P that range from 0% up to 100%) we run 100000

(trials) simulations. The simulations use historical data. The technique is called "coupled resampling" where we pick a

random year, and use the measured values for that year for all three variables (S&P 500 return, 10 year US Treasury bond

return, and US inflation). This technique attempts to capture the inherent correlation between the variables; however, when

used with low resolution data it can create bias in the results. Note we can switch to uncoupled via the variable

coupled_mc.

This next image shows the difference in results between coupled resampling (correlated) and uncoupled resampling (uncorrelated) monte carlo for this particular scenario.

Here is the Fortran code (blend_risk.f90):

program blend_risk use, intrinsic :: iso_fortran_env, only: output_unit, error_unit use :: mrffl_config, only: rk use :: mrffl_us_markets, only: snp_dat, dgs10_dat use :: mrffl_stats, only: rand_int use :: mrffl_us_inflation, only: inf_dat use :: mrffl_percentages, only: p_add=>add_percentage, p_of=>percentage_of implicit none (type, external) integer, parameter :: years = 50 ! Number of years to project out our stocks adjusted value integer, parameter :: trials = 100000 ! Number of trials to run real(kind=rk), parameter :: initial_balance = 4000000 ! This is the balance we will stocks adjusted over the years real(kind=rk), parameter :: initial_withdrawal = 100000 ! Annual withdrawal logical, parameter :: coupled_mc = .TRUE. ! Use coupled resampling real(kind=rk) :: balance, withdrawal, c_snp, c_dgs, c_inf integer :: year, trial, hp integer :: rand_year ! Run monte carlo simulations and dump the results to STDOUT write (output_unit, '(a10,a10,a20)') "trial", "hp", "balance" do hp=0,100 write (error_unit, '(a6,i0)') "hp=", hp do trial=1,trials balance = initial_balance withdrawal = initial_withdrawal do year=1,years if (coupled_mc) then rand_year = rand_int(2023, 2000) c_snp = snp_dat(rand_year) c_dgs = dgs10_dat(rand_year) c_inf = inf_dat(rand_year) else c_snp = snp_dat(rand_int(2023, 2000)) c_dgs = dgs10_dat(rand_int(2023, 2000)) c_inf = inf_dat(rand_int(2023, 2000)) end if balance = p_add(p_of(balance, real(hp, rk)), c_snp) + p_add(p_of(balance, real(100-hp, rk)), c_dgs) balance = balance - min(withdrawal, balance) withdrawal = p_add(withdrawal, max(0.0_rk, c_inf)) end do write (output_unit, '(i10,i10,f20.5)') trial, hp, balance end do end do end program blend_risk

And here is the R code (blend_risk.R):

source('../setup.R') daDat <- fread("blend_risk.txt") %>% mutate(hp=factor(hp)) ## gp <- ggplot(data=daDat %>% filter(hp==75 & balance < 70e6)) + ## geom_histogram(aes(x=balance), col='red', fill='pink', breaks=seq(0, 40e6, by=5e6)) + ## scale_x_continuous(labels = scales::label_dollar(scale_cut = cut_short_scale())) + ## labs(title='Ending balance of making it 50 years on 4M withdrawing 100K annually adjusted by inflation', x='Balance', y='') ## print(gp) successDat <- daDat %>% group_by(hp) %>% summarize(success=100-100*sum(balance<=0)/length(balance), .groups='drop') %>% mutate(hp=as.integer(hp)) gp <- ggplot(data=successDat) + geom_smooth(aes(x=hp, y=success), method="loess", formula='y~x', span=0.2, level=.9999, se=TRUE, linewidth=2) + geom_text(data=successDat %>% filter(success == max(success)), aes(x=hp, y=success, label=paste('Best Chance at ', hp, '% S&P', sep='')), vjust='bottom', hjust='centered', size=6) + labs(title='Chances of making it 50 years on 4M withdrawing 100K annually adjusted by inflation on a mix of bonds and S&P', x='Percentage of portfolio in S&P vs. 10 Year US Treasury Bonds', y='Chance Of Success') fname <- "blend_risk.png" ggsave(fname, width=12, height=10) if (is.character(imageV)) system(paste(imageV, fname, sep=' '))